Okay, so far during this social distancing I’ve done a pretty decent job of staying active. How am I doing it? Well, I’ve got a smart watch/activity tracker helping me along. Not only does it track my exercise, steps, water intake, caffeine intake, sleep, and whole lot more; it also automatically reminds me to stay active.

It does this through notifications to get moving every 50 minutes of non-activity aswell as daily/weekly step tracking summaries. All this, to make sure I’m on track to live a healthy non-sedentary lifestyle!

Let’s switch gears for a moment and turn our focus on financial wellness and retiring with a comfortable lifestyle. Much like my smart watch helps me with my activity my FiscalFitness app helps users stay on track financially.

The functionality of the app includes a budgeting tool that tracks weekly, monthly, and annually; a dynamic forecasting tool utilizing current income to project needed retirement assets; and an automatic investment volatility level alert.

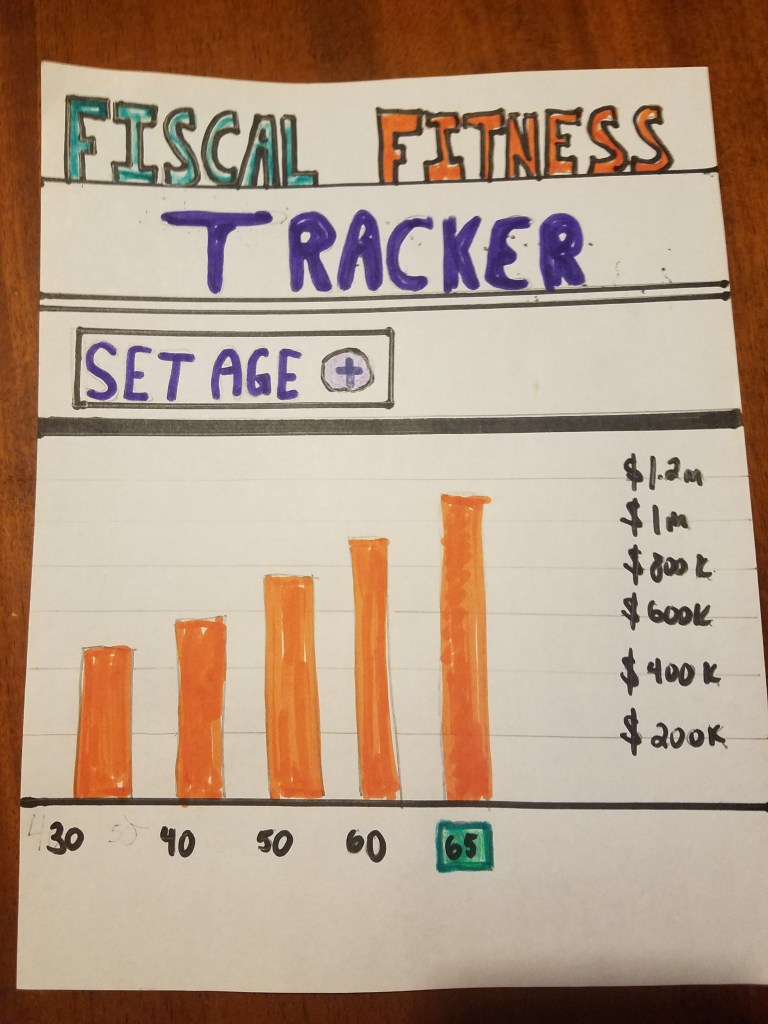

Nobody really knows how much money they’ll need in for retirement. It’s a future number that needs to take into account several variables. One method utilized by a majority of retirement calculators, and a good rule of thumb is to assume you’ll need 70-80% of your current income.

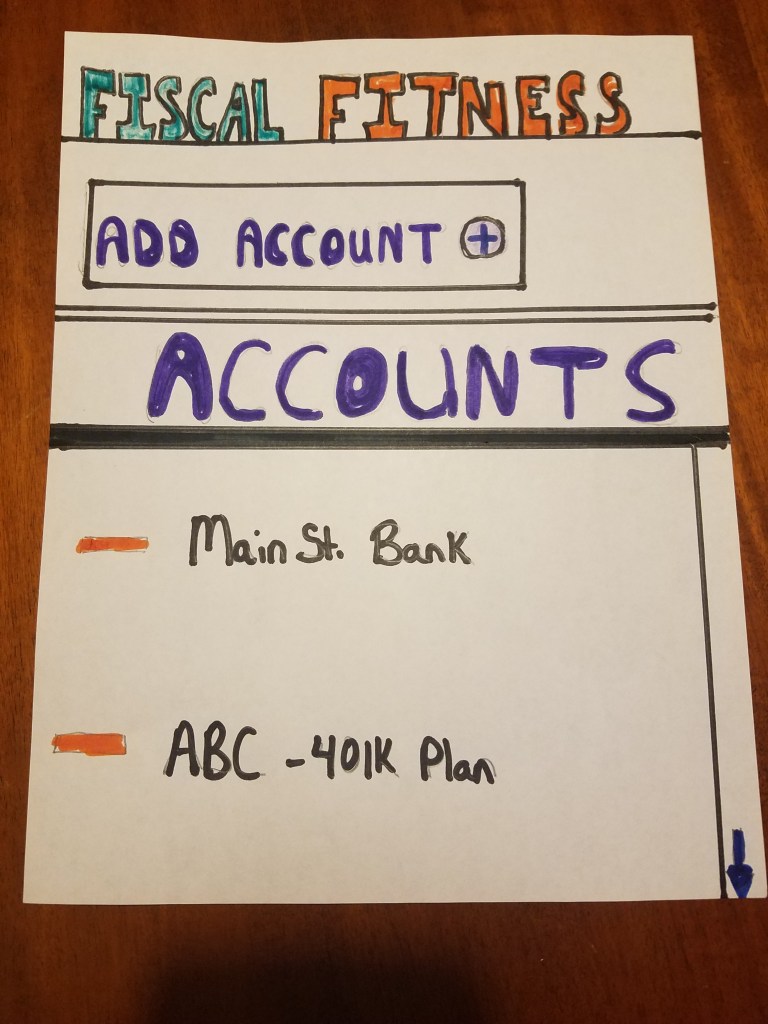

The app will allow the user to include not only their banking and investment accounts, but also any employer retirement plan information and Social Security Benefit assumptions.

With this information the analytical forecasting tool can help the user “stay on track” to hit that retirement number. The tool is also dynamic and can update with any new information added ie – change in income, change in assumed retirement age.

Lastly, the application includes the ability to send out alerts to the user when their investment accounts hit a preset level. This level can be a loss of 10% or 15%; whatever the user wants. Once this percentage is met, an automatic notification is sent via text an email to the user who can then make adjustments to the account or call their adviser.

User will want this app as it will help set/keep budgets which in turn will help with their current financial wellness. At the same time the app will help analyze and track their path to retirement.

Times up! Gotta stay on track…my watch just reminded me to get up and stay active.